The Corporate Sustainability Reporting Directive of the European Parliament and of the Council (CSRD) was passed and published in December 2022. Now, member states have 18 months to implement its provisions into their national legal systems.

The CSRD requires companies to submit annual reports containing data on their impact on the environment, society, human rights and corporate governance.

Reporting will follow the uniform European Sustainability Reporting Standards (ESRS), prepared by the European Financial Reporting Advisory Group (EFRAG).

The new regulations significantly expand the group of companies required to report on environmental protection, social responsibility and respect for human rights, and broaden the reporting requirements compared to the status quo. Therefore, both the objective and subjective scope of the provisions is changing.

Moreover, the provisions of the directive oblige member states to introduce sanctions for incorrect fulfillment of reporting obligations (including administrative financial penalties).

Who will be covered by the CSRD?

The new reporting obligations will ultimately apply to a wide group of companies operating in the European Union, but their introduction has been divided into four stages.

- In 2025 for fiscal year 2024 – an obligation for entities reporting so far under the current Non-Financial Reporting Directive (NFRD), i.e. so-called public interest entities, including public companies;

- In 2026 for the fiscal year 2025 – an obligation for large companies not yet subject to the Non-Financial Reporting Directive; these are companies meeting 2 of 3 criteria: with more than 250 employees, with a balance sheet total of more than EUR 20 million, with annual revenues of more than EUR 40 million;

- In 2027 for the fiscal year 2026 – an obligation for listed SMEs (except microenterprises), small and non-complex credit institutions and captive insurance undertakings;

- In 2029 for the fiscal year 2028 – an obligation for third-country companies, as long as they generate more than EUR 150 million in net sales revenue in the EU and have at least one subsidiary or one branch here with a net turnover of more than EUR 40,000.

The scale of the changes is well illustrated by the numbers. To date, under the NFRD, ESG (environment, social, corporate governance) reporting obligations have applied to ca. 12,000 companies. It is estimated that after the CSRD comes into force, these obligations will apply to ca. 50,000 companies in the European Union.

Report structure

Companies will disclose three levels of indicators in their reports: sector-independent, sector-specific and entity-specific.

The first set of standards covering all companies regardless of their sector and industry has already been published. They have been divided into four groups: cross-cutting, environmental (E), social (S) and corporate governance (G) standards. In total, they contain 84 disclosure requirements, both quantitative and qualitative. The total number of data to be presented in the report is 1144.

Basic reporting standards by group include:

Cross-cutting standards:

- General rules,

- General information,

Environmental standards:

- Climate change,

- Pollution,

- Water and marine resources,

- Biodiversity and ecosystems,

- Resource consumption and a circular economy,

Social standards:

- Employment,

- Employees in the value chain,

- Social environment,

- Consumers and end users,

Corporate governance:

- Business practices.

Publication of sector standards is scheduled in three stages: in November 2023, 2024 and 2025. They will first cover: agriculture, chemicals, fossil fuels, forestry, mining, road transport, textiles and the food industry. In addition, EFRAG will develop simplified standards for SMEs and standards for non-European companies.

Data collection and visualization

The new reporting obligations will pose challenges for both entities that already report and those required to report under the new regulations.

In companies so far subject to the obligation, the report usually takes a descriptive, carefully edited form. It is a document presented in contacts with investors, banks and business partners. However, the form is not its essence. The most important issue is data collection, modeling, management and presentation.

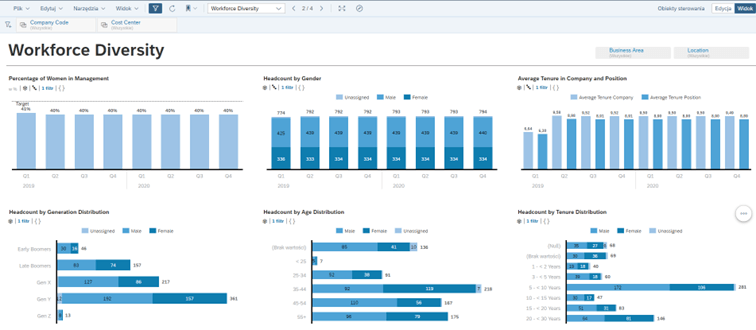

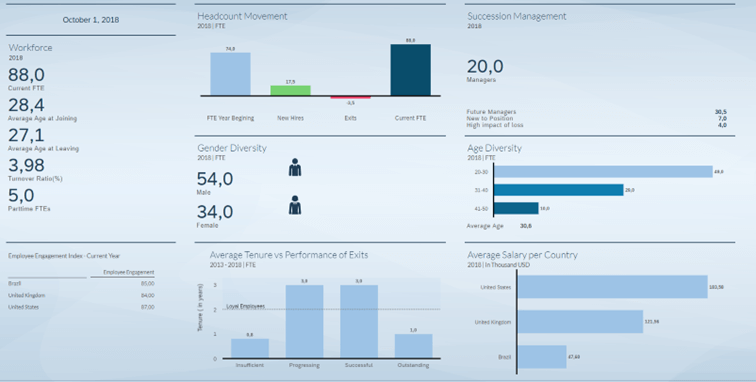

Easy access to data, as well as a clear and attractive way of presenting it is important, especially because one of the report’s target groups is stakeholders, including employees, contractors and investors. In this context, SAP Analytics Cloud is the ideal tool to prepare reports and present data.

SAC for sustainability

SAP Analytics Cloud is SAP’s primary tool for reporting, planning and prediction. It provides an intuitive environment for creating dashboards including charts, tables, maps or text elements. The available reporting components make it easy to compare current data to historical data, set targets or aggregate values. The created dashboards can be made available directly from the SAC to system users, or saved and distributed as a PDF or PowerPoint file. The graphical and transparent form of data presentation will be definitely more attractive to stakeholders, and the ease of access to the data will promote a positive perception of the company.

Due to the diversity of the collected data and its nature, the data from the transaction system is insufficient to create a report in accordance with the guidelines. It is difficult to expect there information about the amount of electricity consumed by its source or pollutants emitted, especially by non-production enterprises. This type of data is most often available outside the transaction system – in external databases or files. SAP Analytics Cloud has the advantage of being able to collect data from different source systems, both on-premise and cloud-based. It is therefore possible for the data necessary for reporting to come from SAP systems (ECC, S/4HANA, BW, BW/4HANA, Datasphere, IBP, SuccessFactors and other), transaction systems of other providers (e.g. TETA, Microsoft, Comarch), SQL databases, OData services, Google Drive or files.

Sample employment reports

compliant with ESG guidelines

All necessary information can be collected in one place where reports will be created at the same time. The need to refer each time in the report to historical data or set goals additionally justifies the existence of one, coherent platform in which this data will be stored and reported.

The aforementioned functionalities are available in the BI (reporting) area in SAP Analytics Cloud. In the case of a sustainability report, it is also worth considering the use of SAP Analytics Cloud in the area of planning or prediction (additionally licensed). Like some of the actual data, set targets and planned values can be loaded into the SAC from the file.

However, if the additional SAC functionality related to planning is used, this data can be entered directly into SAC, automatically aggregated or diversified into detailed values or calculated based on historical data. In addition, the ability to forecast future values based on one of three predictive models (time series, regression or classification function) and the graphical presentation of these values also increase the ease and transparency of the analysis and thus affect the perception of data by stakeholders.

In conclusion

Impacts on the environment and social environment are categories that are gaining importance in business contacts and translate into the possibility of attracting investors, financial and insurance conditions, reputation, employee branding and the company’s position on the market. They are also important for operating costs and the value of assets.

The introduction of integrated reporting will enable stakeholder groups to gain wider access to comparable and reliable high-quality data on sustainability and social responsibility. It will also help avoid additional individual presentation of this information in connection with inquiries from investors, banks and business partners.

Sustainability means not only new responsibilities, but also an opportunity to strengthen competitive advantage.